It’s an old saw, but time in the market is hard to beat.

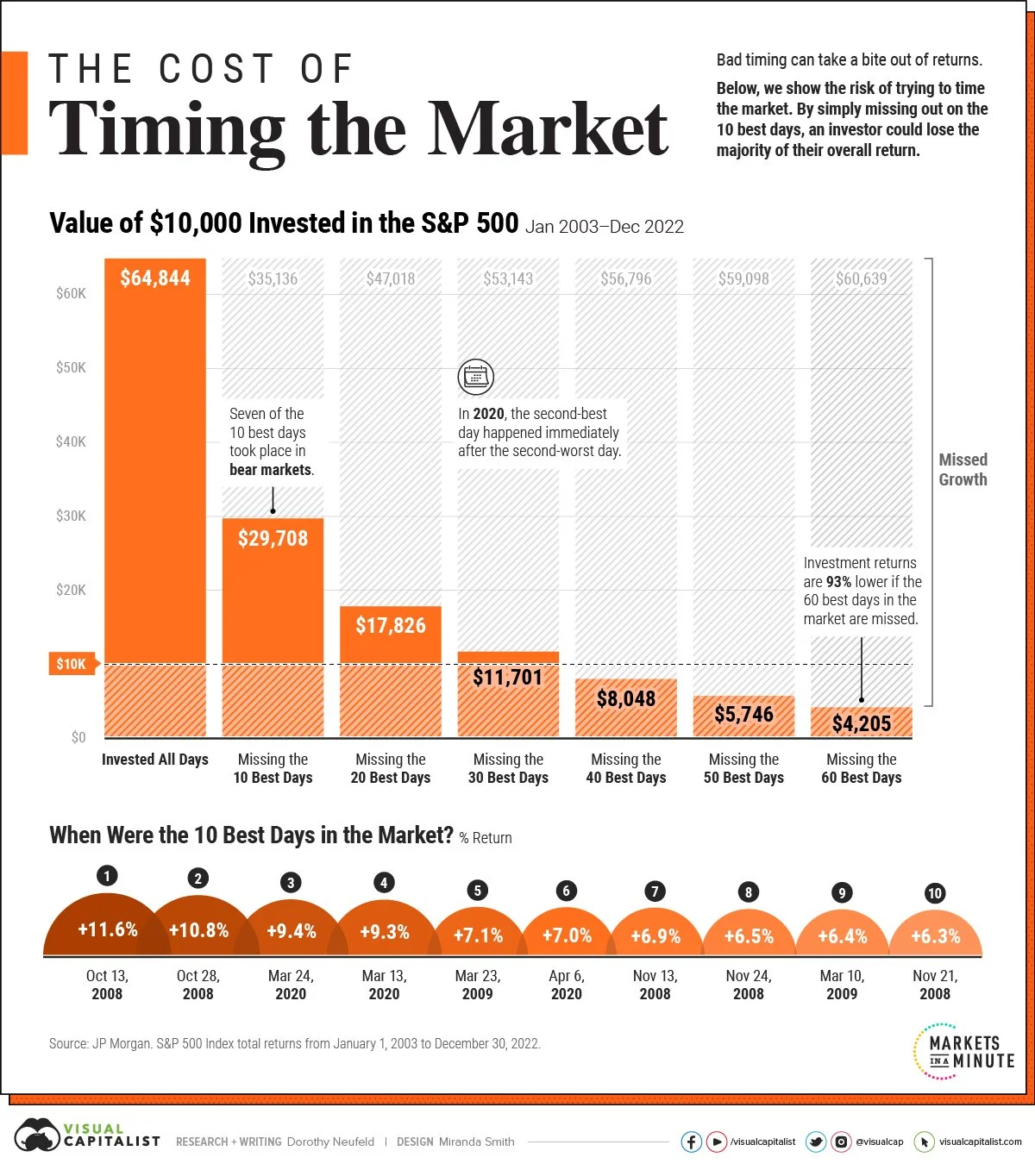

As the above image from Venture Capitalist shows, $10,000 invested in the S&P 500 index between January 1, 2003, and December 30, 2022, can have various outcomes. As I am not typically one to bury a lead, “stay invested” or “hold the course” is today’s message (some may recognize the Jack Bogle verbiage of “hold the course”).

The above image (in table format) bears witness to staying invested:

Invested the entire time - $64,844

Missed the 10 best days - $29,708

Missed the 20 best days - $17,826

Missed the 30 best days - $11,701

Missed the 40 best days - $8,048

Missed the 50 best days - $5,746

Missed the 60 best days - $4,205

Fortunately, or unfortunately (depending on where you fall on the “hold the course” spectrum), the above illustrates how even missing the 10 or 20 best market days over a 20-year time period can have catastrophic consequences upon your portfolio’s returns. Notably, if you tie this (i.e., missing the 10 or 20 best market days) with the difficulty of timing the market (see previous post here about the difficulty of trying to time the market), you are adding unnecessary risk to your portfolio. This is why it is important to fully vet your asset allocation decision. You do not want to be jumping in and out of the market - noting some research whitepapers conclude that asset allocation dictates up to 85% of your portfolio’s returns.

If you have questions about your investment portfolio, please feel free to contact Intelligent Investing at www.mynmfp.com/new-clients for a no-obligation consultation.

For additional information about this topic, please click on the link here.

David L. Hogans, Esq. is an author and the founder of Intelligent Investing, Inc., a registered investment advisor firm located in Albuquerque, NM. He earned his Bachelor of Science in Chemical Engineering (ChE) from Virginia Tech and his Juris Doctorate (JD) from the University of Dayton. Mr. Hogans is licensed to practice law in the states of Virginia and New Mexico, as well as, before the Federal Patent Bar. For more information about Mr. Hogans and his firm please see his ADV filing with the Securities and Exchange Commission (SEC) .